How the Israel-Iran Conflict is Shaping GCC Trade and Economic Trajectories

Amid heightened Middle East tensions, the Israel-Iran conflict is influencing GCC trade patterns, energy markets, and foreign investment flows. With 21 million barrels of oil passing daily through the Strait of Hormuz and regional FDI trends shifting in 2025, Gulf countries are balancing risk with resilience.The latest escalation between Israel and Iran is reverberating through the global economy, particularly in the Gulf Cooperation Council (GCC) region. Despite the regional conflict, as per World Bank, economic growth in the GCC region is expected to pick up pace over the next two years, with forecasts indicating a rise to 3.2 percent in 2025 and further to 4.5 percent in 2026. This upward trend is likely to be supported by the expected easing of Organization of the Petroleum Exporting Countries (OPEC+) oil production limits, alongside continued momentum in non-oil sectors such as manufacturing, logistics, and services.

Update: June 24, 2025 – Israel-Iran conflict escalates despite ceasefire: GCC risk landscape shifts

The fragile ceasefire between Israel and Iran, brokered just hours earlier by the United States and Qatar, was swiftly tested as Israel and Iran resumed airstrikes and missile activity. Risk assessments across the GCC include:- Sovereign risk and market sentiment: Geopolitical risk assessments for Bahrain and Kuwait have softened, with sovereign risk premiums under pressure amid elevated regional tensions. While formal rating downgrades have not materialized, major credit rating agencies have flagged increased downside risk.

- Energy and maritime security: Brent crude, which had spiked above US$78 in response to initial Israeli strikes, briefly plunged below US$70 following the ceasefire announcement. However, analysts warn that any disruption to the Strait of Hormuz, through which over one-fifth of global oil transits, could push prices sharply higher.

- Insurance and logistics: Insurance premiums for Gulf shipping routes rose sharply in the hours following renewed hostilities. While levels normalized after the ceasefire announcement, the volatility has led many insurers to revise their near-term exposure models.

- Airspace closures: Qatar led the move by closing its skies during the air baseattack, followed by Kuwait, Bahrain, and the UAE—though these have been briefly reopened as of late June 23. Saudi Arabia and Jordan also enforced temporary airspace restrictions, aligning with broader regional measures

- Flight disruptions: Major carriers—such as Emirates, Etihad, Qatar Airways, FlyDubai, Air India, British Airways, KLM, Singapore Airlines—either cancelled or rerouted flights to Gulf hubs. Dubai’s airports have resumed full operations, but delays and backlog persist.

- Land transport and border controls: While no GCC nation officially closed land borders, Saudi Arabia has implemented aviation restrictions near its border with Qatar. Israel and Iran have both sealed land crossings, prompting some Gulf-bound travelers to use alternate overland routes through Jordan and Iraq.

Update: June 21 to June 23, 2025 – US launches targeted airstrikes on Iran’s nuclear infrastructure, Iranian Parliament proposes the closure of the Strait of Hormuz

On June 21, 2025, the United States launched targeted airstrikes on Iran’s nuclear infrastructure, hitting key facilities in Fordow, Natanz, and Isfahan with precision bunker-busting munitions. In response, Iran’s Parliament has proposed the closure of the Strait of Hormuz—a strategic chokepoint for nearly one-third of global seaborne oil trade.

While the Strait remains operational as of June 23, heightened military activity, GPS jamming, and partial traffic diversions have increased regional risk. Shipping insurance premiums have surged by over 60 percent for tankers transiting the Gulf, and global crude prices spiked by 7-11 percent, with Brent crude surpassing US$80 per barrel.

Experts caution that a full closure remains unlikely due to the economic costs for Iran and the presence of US naval forces in the region. Still, the developments mark a significant inflection point for energy markets and Gulf trade dynamics.

Impact of conflict on Strait of Hormuz and energy markets

Approximately one-third of global seaborne oil, about 21 million barrels daily, flows through the Strait of Hormuz. Amid the recent escalation, oil prices have spiked nearly 4.4 percent, with Brent crude temporarily rising to US$78.85 per barrel, the highest level since January. Conservative lawmakers in Iran have floated the possibility of blocking the Strait, although historical precedent (for example, the Iran-Iraq war) shows that full closures remain unlikely due to mutual economic dependencies, including Iran’s own exports to China. Iran produces 3.3 million barrels per day and exports about 1.7 million barrels, largely to China. Iran has world’s third largest reserves of crude oil and second largest reserves of gas. Disruption to Iranian oil alone could eliminate the projected global supply surplus, nudging prices toward the US$80 per barrel point. Although OPEC possesses 5 million barrels per day of spare capacity, much of it sits in the Gulf and cannot bypass Hormuz. Analysts at Goldman Sachs predict that a prolonged crisis could push prices past US$100 per barrel, especially if the disruption proves structural. This could lead to inflationary shocks, especially in oil-importing countries, while straining central bank policy flexibility globally.Economic scenarios and policy dilemmas in front of GCC

International economic forecasts, including those from S&P Global and Independent Commodity Intelligence Services (ICIS), model three potential conflict scenarios, ranging from diplomatic de-escalation to full-scale regional warfare. For GCC economies, the middle-ground scenario of prolonged proxy conflict appears most plausible. This would maintain a high geopolitical risk premium in oil markets, elevating inflation and logistics costs.- De-escalation scenario: The conflict de-escalates with limited and symbolic retaliatory actions, resulting in minimal oil price movements. Markets are likely to recover swiftly, and trade disruptions remain contained, allowing GCC economies to resume planned growth trajectories.

- Proxy war scenario: Proxy engagements continue through cyberattacks, minor military strikes, and sporadic disruptions to logistics networks. Oil prices remain volatile for a prolonged period, leading to higher transportation and insurance costs. But the regional economic impact remains moderate.

- Conflict continues scenario: A full-scale regional escalation leads to the closure of the Strait of Hormuz. This would disrupt a significant share of global oil trade, likely pushing the global economy toward recession and triggering capital flight from risk-sensitive regions, including the GCC.

GCC trade and supply chain concerns

The economic backbone of the GCC region depends on energy exports and maritime trade. With airspace closures affecting Iraq, Iran, Jordan, and Lebanon, several Gulf-based airlines, including Emirates, Etihad Airways, and Qatar Airways, have suspended or rerouted flights, reflecting wider supply chain disruptions. Also, the freight rates and shipping insurance premiums in the Gulf have climbed up by 15 percent to 30 percent amid increasing risk. Insurance companies are also levying 0.15 percent of cargo’s value as an additional charge. While commercial ports in UAE, Saudi Arabia, and Qatar remain operational, logistics firms report longer lead times and rising operational costs, impacting sectors like petrochemicals, aluminum, and automotive exports. Airlines including Qatar Airways, Etihad, and Emirates have advised caution, with temporary cancellations in place. Such disruptions affect time-sensitive sectors like luxury retail, medical logistics, and business travel, pushing enterprises to reassess risk insurance and contingency routes.FDI and capital reallocations across GCC

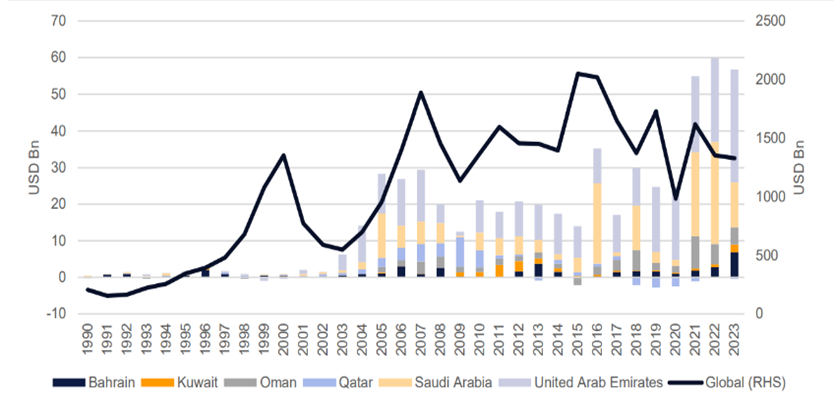

Source: UNCTAD World Investment Report 2024, Emirates NBD Research

After a decade of steady growth, Foreign Direct Investment (FDI) into the Gulf Cooperation Council is expected to moderate in 2025, according to S&P Global Market Intelligence. The reasons are many, ranging from heightened geopolitical uncertainty and volatile oil prices to slower-than-expected progress on flagship economic transformation programs like Saudi Arabia’s Vision 2030 and the UAE’s push toward green energy.

But this moderation does not signal a retreat from the region. While some global capital has turned more cautious, core areas such as infrastructure, tourism, and logistics continue to attract interest, and there is a visible pivot toward future-oriented segments like green hydrogen, mobility technology, and digital infrastructure.

Much of the current momentum is being sustained by intra-GCC investment, as sovereign wealth funds increasingly channel capital into domestic projects that reinforce national resilience and long-term growth. This inward shift also highlights growing confidence in local economic fundamentals. For long-term investors, the region still offers a stable platform, especially for those willing to ride out short-term uncertainty.

Read more: GCC IPO Market Q1 2025: Resilient Growth Led by Saudi Arabia, UAE, and Oman

Source: UNCTAD World Investment Report 2024, Emirates NBD Research

After a decade of steady growth, Foreign Direct Investment (FDI) into the Gulf Cooperation Council is expected to moderate in 2025, according to S&P Global Market Intelligence. The reasons are many, ranging from heightened geopolitical uncertainty and volatile oil prices to slower-than-expected progress on flagship economic transformation programs like Saudi Arabia’s Vision 2030 and the UAE’s push toward green energy.

But this moderation does not signal a retreat from the region. While some global capital has turned more cautious, core areas such as infrastructure, tourism, and logistics continue to attract interest, and there is a visible pivot toward future-oriented segments like green hydrogen, mobility technology, and digital infrastructure.

Much of the current momentum is being sustained by intra-GCC investment, as sovereign wealth funds increasingly channel capital into domestic projects that reinforce national resilience and long-term growth. This inward shift also highlights growing confidence in local economic fundamentals. For long-term investors, the region still offers a stable platform, especially for those willing to ride out short-term uncertainty.

Read more: GCC IPO Market Q1 2025: Resilient Growth Led by Saudi Arabia, UAE, and Oman

Monetary policy and inflationary response to the conflict

Central banks in the GCC are tracking the oil price trends as they assess the region’s inflation outlook. If Brent crude stays elevated due to prolonged tension, monetary authorities may be forced to delay easing cycles or reconsider exchange rate interventions. GCC currencies like the Saudi riyal and UAE dirham are pegged to the U.S. dollar, amplifying exposure to global dollar movements and complicating local monetary autonomy. Increased energy and food import costs could force GCC governments to expand subsidies or delay monetary easing. Inflation is expected to rise in tandem with imported fuel and food costs, especially in countries with large expatriate populations and high import dependence. According to the World Bank, headline inflation across GCC countries have remained subdued in 2024, even as regional central banks implemented interest rate cuts. Inflation averaged 2.0 percent for the year, easing slightly from 2.2 percent in 2023. Unlike previous years, 2024 marked a shift in monetary policy, with GCC nations reducing interest rates in line with moves by the US Federal Reserve.GCC stock and equity market response

Financial markets across the Middle East have shown mixed responses. Egypt’s EGX 30 index fell 7.7 percent in one week, while the Tel Aviv Stock Exchange dropped 1.5 percent. Gulf equities, particularly those listed on the Tadawul (Saudi Arabia) and ADX (UAE), initially remained resilient due to liquidity and investor confidence but have since shown volatility as uncertainty persists. Credit markets have also tightened, though abundant liquidity has so far offset negative spread reactions. The risk lies in sustained energy price pressure. It can erode corporate margins and amplify default risks in capital-intensive sectors like construction and manufacturing.Investor considerations

While the conflict poses risks, GCC states continue to offer compelling value for long-term investors due to their strategic location, strong sovereign ratings, and diversification initiatives. However, investors must weigh the following when assessing opportunities in the region. First, portfolios with exposure to the energy and logistics sectors will need to factor in geopolitical risk premiums when evaluating expected returns. Second, rising insurance and shipping costs may impact overall trade margins, particularly for exporters and manufacturers operating across volatile routes. Finally, inflation driven by elevated oil prices could delay interest rate cuts by central banks, which may in turn affect liquidity conditions and dampen consumer demand in the short term.In brief

The Israel-Iran conflict is a critical inflection point for the GCC, testing the resilience of its economic diversification and trade architecture. The extent of impact will depend on whether tensions evolve into a prolonged shadow war or are quickly contained through diplomacy. For businesses and investors engaged in the region, the imperative is clear: stress-test exposure, monitor shipping channels and risk assumptions for volatile times. This article was first published on June 20, 2025, in the context of rising Israel-Iran tensions and their economic impact on the GCC. Given the recent escalation, we are now providing regular updates.This article first appeared on Middle East Briefing, our sister platform.